IN THE JUNE EDITION of Compound Semiconductor, I always take a look at changes in the share prices of leading companies in our industry.

As I embarked on the task this year, I had a sense of dread. I knew that while the most devasting impact of the Covid-19 pandemic had been the loss of hundreds and thousands of lives, a heavy toll had been inflicted on the economy. Millions of jobs have disappeared, and there have been unprecedented falls in the price of numerous shares.

But not all shares have fallen far – and some have made a great recovery. In general, tech stocks tend to have fared well, and as is the case in many years, if you had backed the right firms within our industry, your portfolio will have gained in value – and if you had backed the wrong horses, you would be out of pocket.

Maybe the relative success of our industry is not as surprising as it first appears. For starters, many chipmakers have not had to shut their fabs, because governments deem them as an essential activity. And the devices they are churning out are being deployed in products in high demand that are needed to get us all through the crisis.

Take Lumentum, for example, occupying second spot on this year’s Share Price Leaderboard. The impact of Covid-19 on its business has been well documented in a candid conference call on 5 May discussing third fiscal quarter earnings. During that call company CEO Alan Lowe revealed that while revenues took only a relatively small hit in the third quarter, they will take a far bigger one in the fourth. Note that this admission did not spook the markets, which must believe that Lowe is handling this crisis well. Instead, the company’s valuation went up a few percent.

Lumentum is a multi-national, running wafer fabs on three continents, and the spread of the pandemic has exacerbated the challenge. Issues were first felt at the manufacturing facility in Shenzhen, China, which struggled after Chinese New Year, due to difficulties in obtaining supplies from third-parties. While this situation is now improving, the facility in Malaysia is only just starting to recover after a three week shut down and fabs in the US, the UK and Japan are not at operating at full throttle, due to the social distancing measures.

Many companies will be experiencing similar problems to those of Lumentum. Let’s be under no illusion that the coming months will be tough, but with our fabs still running, we are in a far better position than that facing many other sectors.

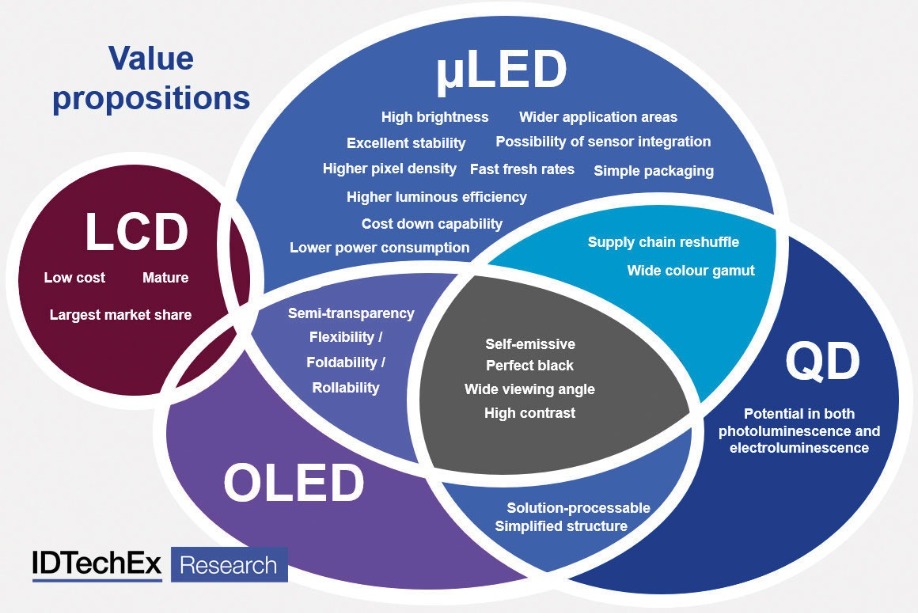

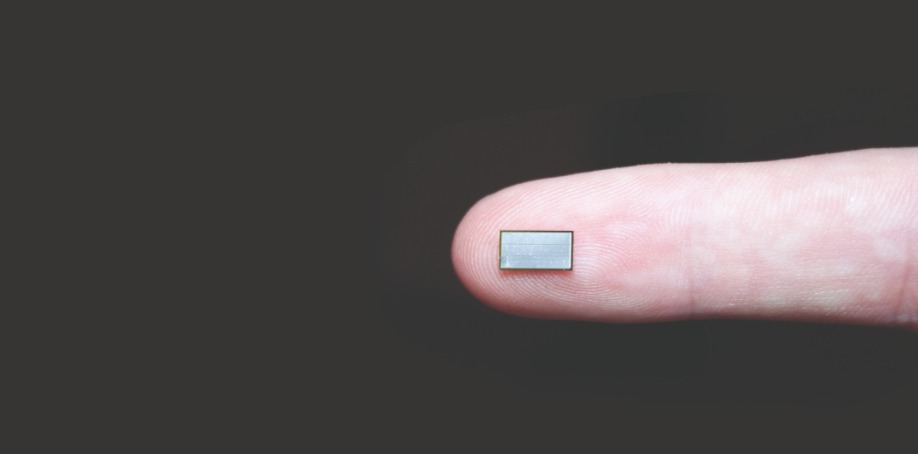

Micro-LEDs could become a mainstream technology for displays of all sizes, according to IDTechEx, which outlines the challenges and opportunities in a new report MicroLED Displays 2020-2030: Technology, Commercialisation, Opportunity, Market and Players.

Display markets today are dominated by LCDs, whose manufacturing is shifting to China for cost reasons. OLED technology is used in premium displays and is dominated by South Korean firms. MicroLEDs open up some new opportunities, says IDTechEx. They offer a wide colour gamut, high luminance, low power consumption, excellent stability and long lifetime, wide view angle, high dynamic range, high contrast, fast refresh rate, transparency, seamless connection, and sensor integration capability.

An increasing number of MicroLED prototypes have already been displayed to the public, but there are still engineering and manufacturing issues to overcome. For instance, conventional LEDs can reach external quantum efficiencies as high as 70 percent, while tiny microLEDs less than 10 μm in size may struggle to reach 20 percent. Red LEDs are especially challenging, with low efficiencies and brittle features. Tiny microLEDs have large surface areas, which may lead to more defects during the fabrication process.

Solving engineering/manufacturing challenges is important, including die size miniaturisation while maintaining the high efficiency, chip design and chip manufacturing technique improvement.

There are many steps and processes to fabricate a microLED display, with varied difficulties. In earlier years, the major focuses of research and development were on die miniaturisation, chip design, efficiency enhancement, mass transfer and full colour realisation.

Recently, more and more players realise a complete understanding of all of the processes is the key. Therefore, an increasing number of firms have put more efforts into technologies such as inspection, repair, driving, image improvement, light management and high-volume production equipment.

Involving multiple existing industries and new industries, micoLED displays may re-shape the existing LED and display supply chain, resulting in a lengthy and complex new one. New technology approaches and new products can also provide new opportunities for the players, such as the CMOS industry taking a position in the microLED-based micro-display supply chain.

Each player will optimise their gain in the value chain, and therefore, a deep understanding of the technology and market status is important.

Luminus Devices, a US start-up that uses technology originated from Massachusetts Institute of Technology (MIT), has announced the availability of its newest UVC LED, the XBT-3535, with performance ranging from 50 mW to

80 mW in the 275-285 nm range.

According to the company, the price-performance combination of the XBT-3535 will allow companies to quickly bring novel and affordable disinfection and sterilisation solutions to market.

The germicidal effectiveness of UVC LEDs against E-coli, MRSA and a variety of pathogens has been well documented. UVC LEDs with wavelengths shorter than 280 nm are shown to be as or more effective than mercury lamps for disinfection and sterilisation. However, performance, cost, and lifetime have been, in some combination, the factors slowing adoption of UVC LEDs.

“Luminus’ mission is to improve people’s health and wellness by making LED-based disinfection technology universally affordable in healthcare, water- and air-purification applications,” said Murali Kumar, director of specialty marketing.

“Our latest devices, like the new XBT-3535 from Luminus, now have median lifetimes well in excess of 10,000 hours at nominal operating conditions, their increased power output minimises the number of LEDs required in a system, and pricing in volume has been reduced to a level below $0.10/mW. The convergence of these three factors makes the large-scale deployment of UVC LEDs practical and accelerates the phase-out of lamps containing harmful substances such as mercury.”

According to a new report by Global Market Insights, the market valuation of infrared LEDs will cross $1 billion and shipments cross 8 billion units by 2026.

IR LEDs of wavelength 700 nm – 850 nm are likely to witness the strongest growth over the forecast period owing to their increasing applications in medical treatment appliances and IR illumination in solid-state lasers.

Favourable government regulations to mandate the use of IR lighting to ensure driver safety will add an opportunity for market growth.

This has led to manufacturers investing in interior and exterior lighting applications, such as night vision lighting systems, head-up displays, and front lighting with active bending features, driving the demand for IR LEDs.

The rising demand for a strong surveillance system worldwide is also likely to boost IR LED market growth over the coming years. The integration of disruptive technologies with surveillance systems, such as smart sensors and IoT, to improve the performance will add an opportunity for market growth. These systems are experiencing high adoption from military applications, smart cities, industries, among others.

The 950 nm –1020 nm segment held a market share of over 5 percent in 2019 and is likely to grow at a CAGR of

5 percent over the forecast period, according to the report.

These high-wavelength devices are used for light sources for remote controller, infrared communications, and photo couplers. This will increase their adoption in applications such as surveillance cameras, sensors for factory automation, infrared range finders for digital cameras, and smoke detectors.

Imaging applications are anticipated to register a CAGR of over 7 percent over the forecast period.

IR LEDs for image processing are used in a wide range of applications such as defence & security, medicine, industrial, and handheld mobile devices.

Global smartphone shipments dropped by 16.8 percent in the first quarter as vendors struggled to manage coronavirus-driven production shutdowns, product-launch delays and depressed consumer demand.

Shipments in the first quarter fell to 274.4 million units, down from 329.9 million during the same period in 2019, according to the Omdia Smartphone Intelligence Service. This plunge impacted all the major smartphone brands, with nine of the top-10 OEMs suffering shipment declines compared to the first quarter of 2019.

“Early in the first quarter, the smartphone market was sent reeling by the shutdown of production at facilities in China, which halted the manufacturing of phones and their key components,” said Jusy Hong, smartphone research and analysis director at Omdia.

“While concerns about this situation have been alleviated, the smartphone brands also faced new challenges, including disrupted launch schedules for new phones. Even more troubling for smartphone makers is a major decline in global demand due to government lockdown mandates.”

Despite expected rebounds in some countries, the rest of the year is expected to be challenging for smartphone OEMs. Omdia forecasts global smartphone shipments will decline to 1.20 billion units this year, down 13.1 percent from 1.39 billion in 2019.

Almost across the board, smartphone OEMs faced significant declines in unit shipments compared to the first quarter of 2019.

Samsung retained the top position, with 58.9 million units shipped during the first quarter – a 17 percent decline compared to the first quarter of 2019.

Second-ranked Huawei saw its shipments decline by more than 17 percent, to 49 million units, down from 59.1 million in the first quarter of 2019. Apple, in third place, saw shipments decline to 38.5 million units, down from 43.8 million a year earlier. The 12.0 percent decline comes during the first quarter, historically the weakest period of the year for Apple.

Rounding out the Top 5 are Xiaomi and Oppo. Out of the Top 10, Xiaomi experienced the second least severe decline in the quarter, of 8.2 percent. Only Tecno, in 10th place, attained a lower decrease with a 7.6 percent year-over-year decline. Xiaomi shipped 25.3 million units in the first quarter, compared to 27.5 million units in 2019. Oppo, on the other hand, suffered a 19.2 percent decline, with shipments falling to 20.4 million units, down from 25.2 million a year earlier.

The rest of the Top 10 is made up of vivo, Realme, Motorola, LG, and Tecno. The bright spot here is Realme, which achieved year-over-year growth based on its continued success in India. Seventh-ranked Realme was the only top-10 OEM to attain growth during the quarter, with shipments totaling 6.1 million units, up 88 percent from 3.2 million during the first quarter of 2019.

For the others in this group, the first quarter brought significant challenges. Looking at vivo, company shipments declined 19.9 percent, falling from 24.3 million units last year to 19.5 million this year. Motorola, in eighth place, saw shipments decline 35.4 percent to 5.5 million units. While Motorola finally launched its updated RAZR, featuring a foldable display, the publicity surrounding that high-profile device was not enough to support the overall performance of Motorola’s product portfolio.

With or without the impact of the pandemic, LG continues to struggle with its mobile handset division. Shipments declined to 5.4 million units, down from 8.6 million units a year ago – a drop of 37.4 percent. Rounding out the top 10 is Tecno, which saw units decline by a relatively modest 7.6 percent, declining from 3.8 million units last year to 3.5 million units in the first quarter.

“The smartphone market will face major struggles in the first half of 2020 as different countries experience the initial shock and recovery periods at different times. That’s why OEMs are more afraid of second-quarter sales results,” Hong said. “However, Omdia does expect the smartphone market to start to recover in some countries and regions in the second half of the year.”

Early in the first quarter, the most severe impact on the smartphone market was the shutdown of production and supply chain facilities in China. However, fears over a prolonged closure of essential production, supply chain and logistics operations in China have been alleviated, as signs point to economic activity ramping up quickly in the country.

Smartphone makers in the first quarter also had their product-launch plans disrupted by the cancellation of the Mobile World Congress event in Barcelona, Spain, where many companies had planned to roll out new products.

“Because of the cancellation of the Mobile World Congress, and uncertainty in the supply chain, original product schedules had to be re-evaluated,” said Gerrit Schneemann, senior analyst, smartphones, at Omdia. “However, OEMs seem to have found their footing on how to address new device launches going forward.”

The impact of the outbreak on the smartphone business has now shifted almost completely to the demand side of the equation.

“Although handsets can be produced at nearly normal levels, the markets for these handsets are mostly in some state of shutdown,” Hong said. “Some countries have made more progress in dealing with the outbreak, while others are still in the midst of fighting the pandemic, and still others won’t feel the full effects of the pandemic until later in the year.”

In Europe, where some countries have been under strict lockdown rules for some time, initial efforts have been made to ease restrictions.

Power Integrations has announced that its InnoSwitch3-MX isolated switcher IC family has been expanded with the addition of three new PowiGaN devices.

As part of a chipset with Power Integrations’ InnoMux controller IC, the new switcher ICs now support display and appliance power supply applications with a continuous output power of up to 75 W without a heatsink.

The InnoMux chipset employs a single-stage power architecture that reduces losses in display applications by

50 percent when compared with conventional designs, increasing overall efficiency to 91 percent in constant-voltage and constant-current LED backlight driver designs.

Additionally, by eliminating the need for post regulation (i.e. buck and boost) stages, TV and monitor designers can halve component count, improving reliability and reducing manufacturing cost.

With a high breakdown voltage of 750 V, the PowiGaN InnoSwitch3-MX parts are also extremely robust and highly-resistant to the line surges and swells commonly-seen in regions with unstable mains voltages.

InnoSwitch3-MX flyback switcher ICs combine the primary switch, the primary-side controller, a secondary-side synchronous rectification controller, and PI’s innovative FluxLink high-speed communications link.

The InnoSwitch3-MX receives control instructions from its chipset partner InnoMux IC, which independently measures the load requirements of each output and directs the switcher IC to deliver the right amount of power to each output, maintaining accurate regulation of current or voltage.

“By using our PowiGaN technology we are able to address higher-output applications in TVs, monitors and appliances that employ LED displays. The chipset increases efficiency beyond the requirements of all mandatory regulations and improves manufacturers’ scores in EU efficiency labeling programs,” said Power Integrations’ product marketing manager Edward Ong.

MKS Instruments has announced the Ophir FluxGage 604 compact measurement system for LED luminaires.

This new series features four additional colour sensors evenly arranged in the bottom of the device delivering further x,y, and CCT data as well as the illuminance.

Within seconds the user gets an overview of the colour and overall uniformity of the measured light, according to MKS. This allows direct evaluation of LED chips or optical assemblies used for colour mixing and beam shaping within the design process in order to find the optics that provide the optimal light for a particular application.

The system can also be used in end-of-line LED luminaire production applications to instantly detect issues, ensuring high-quality product standards are met. The Ophir FluxGage measurement system also measures total luminous flux, colour parameters and flicker.

“Knowing the uniformity of light is important in a wide variety of applications, such as lighting in industrial, educational, or medical facilities; offices; TV studios; as well as streets, parks, and other urban spaces,” said Simon Rankel, business development manager LED for the Ophir brand.

“Historically, it has been challenging to measure the colour uniformity of LED luminaires as measurement devices like goniometers deliver a detailed analysis but are large, relatively slow, and expensive.”

“Ophir FluxGage 604 measurement system revolutionizes the testing of LED luminaires as the compact system only needs a space the size of the luminaire being tested, which makes handling easy. In addition, measurements can be performed in less than two seconds and literally in any environment.”

Ophir FluxGage 604 measurement system features smart tristimulus (RGB) colour sensors that boost the measurement system’s capabilities, making it suitable for fast testing, both in R&D and for quality control in a production environment. All photometric measurements are performed in 2p geometry, thus the colour distribution of LED assemblies and luminaries can easily be evaluated with the FluxGage system.

In addition, the new colour-sensor functionality enables useful comparisons of the colour-mixing performance of LED lenses, reflectors, diffusers, and homogenisers without the need for an expensive goniometer.

As the total luminous flux of the different LED luminaires can vary significantly depending on its application, Ophir FluxGage 604 measurement system is available in two sensitivities to deliver precise measurements.

The standard FluxGage 604 measurement system measures LED luminaires in a luminous flux range between 500 and 40,000 lumens. The high-sensitivity FluxGage 604/100LM measurement system covers the range between 100 and 5,000 lumens. Both versions include four sensors to measure colour uniformity.

All FluxGage systems are based on technology that uses solar panels as light detectors. The panels are arranged on the inside walls of the measurement cavity and are covered with a special black layer with hundreds of transparent pinholes, creating the effect of many tiny radiometers.

MKS says that the design significantly reduces the reflectance of the solar panels, creating a measurement system resembling a goniophotometer in a dark room.

Unlike an integrating sphere, the FluxGage system is insensitive to reflections going back and forth between the measurement device and the luminaire under test.

Luminous flux and other colour parameters are calculated based on the measurements of the integrated spectrometer; a fast photodiode is used for measuring flicker.

Integrated application software simplifies set up and operation; all of the photometric data of the light source is displayed. The FluxGage system connects to a PC via a USB cable. The Ophir FGC100, a NIST-traceable, broadband LED calibration standard, is used for periodic calibration of the FluxGage system.

Aixtron’s supervisory board has appointed Jochen Linck as a new member of the executive board with effect from December 1, 2020 or earlier in the role of chief technical and chief operating officer. At his own request, board member Bernd Schulte will retire at the expiry of his contract on March 31, 2021, and Felix Grawert will take over as chairman and CEO.

Linck’s appointment is for three years. As of April 1, 2021, he will assume responsibility at Aixtron for the areas of development, purchasing, manufacturing and logistics, quality management and IT.

Linck has many years of experience in international management functions in various areas such as development, product management or launch management. The 54-year-old most recently served on the Executive Committee of Diebold Nixdorf. a global provider of cash management and self-service machines for banking and retail.

As managing director of DN Systems, he was responsible for the development and launch of a new product generation of ATMs. Prior to this, the engineer with a PhD in lean production was a partner at McKinsey & Company, with a functional focus on product development, production and strategy in the mechanical engineering, aerospace and automotive industries.

The supervisory board considers the technology expert with many years of management experience to be the ideal person to lead Aixtron into the next growth phase together with his colleagues on the board and the entire team. In addition, the executive board is to be expanded to include a CFO, bringing the total number of members to three. The Supervisory Board’s Nomination Committee is working to soon fill this position.

Aixtron’s technologies address a number of different growth markets, for which market researchers predict double-digit annual growth rates over the next few years. Aixtron intends to benefit from this growth and, with an expanded board, sees itself well set up for the future.

Bernd Schulte has been with Aixtron since 1993 in various positions and has been a member of the board since 2002. Today, he manages the company together with Felix Grawert and intends to retire when his board contract expires in March 2021. Until then, Schulte will be at full disposal to the Company and the board to actively support his new colleagues.

Kim Schindelhauer, chairman of the Supervisory Board of Aixtron SE comments: “We would like to express our special thanks to Bernd Schulte, who has accompanied and successfully led Aixtron for more than 28 years at the time of his retirement. Schulte has shaped Aixtron with his deep understanding of technology, close customer relationships and entrepreneurial drive, and has made a significant contribution to the company’s success. On behalf of the Supervisory Board, I would like to thank Schulte for his many years of successful service to the company. The Supervisory Board wishes him all the best for his personal future”.

“The generational change in the Aixtron Group’s leadership has started with the appointment of Felix Grawert in 2017. The appointment of Jochen Linck and the soon to be appointed CFO, will then complete the generational change. With this management team, the company is excellently positioned for future growth,” explains Kim Schindelhauer.

Osram Opto Semiconductors has announced a new family of LEDs called Synios S 2222, suitable for a wide range of applications: from customised lighting solutions for electronic devices, ambient lighting for trains and planes to high-quality architectural lighting.

The product family has compact dimensions, combined with very good brightness values and the ability to cover the entire colour palette.

Osram says the new family provides an efficient and flexible platform for a variety of low- and mid-power applications, and spans 10 mA to 200 mA. Customers can choose from six colours and combine them to create more. In addition to white versions (3000 – 6500 K, CRI >80), the product family includes versions in blue (445 nm – 460 nm), green (520 nm – 540 nm), yellow (583 nm – 595 nm, conversion and direct emission), red (612 nm –

626 nm) and deep red (626 nm – 636 nm).

The family’s uniform dimensions of 2.2 mm x 2.2 mm and solder pad design make it particularly easy to integrate into many different solutions. The low package height of only 0.6 mm makes extremely flat lighting solutions possible.

Osram is responding to the trend of producing ever smaller discrete components with the highest possible performance.

For example, the yellow converted variant delivers an outstanding brightness value of 50 lumen at 140 mA. Depending on the application, additional optics can be easily applied to the respective component due to the centric chip position in the package.

“With the Synios S 2222 product family, we offer our customers compact, high-quality LEDs to help them easily realise individualised lighting solutions. “

“Thanks to the special package design, the products are easy to handle via pick and place in series production,” explains Alvaro Wulff, Product Manager for Illumination at Osram Opto Semiconductors.

“Depending on the application, customers can choose from a wide range of colours while benefiting from our latest chip and package technologies.”

With a heavy dependence on cellular terminals, recent forecasts of declining handset shipments in response to the Covid-19 pandemic will result in lower GaAs device revenue in 2020. This is a conclusion of the Strategy Analytics Advanced Semiconductor Application (ASA) insight A First Look at the Effects of COVID-19 on GaAs Revenue.

Based on current trends in several application segments, the insight forecasts a likely trajectory for GaAs revenue out to 2025.

“GaAs RF device revenue growth has struggled in recent years and revenue actually declined for the first time in many years in 2019,” noted Eric Higham Director of the Advanced Semiconductor Applications (ASA) service. “GaAs revenue links closely to trends in the cellular segment, so recent forecasts of sharp drops in smartphone shipments caused by the Covid-19 pandemic will contribute to further declines in GaAs revenue.”

He went on to say, “The complete effects of Covid-19 on the supply chain remain unclear, but I’m optimistic about the future of GaAs device revenue. Based on the most recent information, 5G will become a strong growth engine and GaAs device revenue should be reaching new highs in the next few years.”

SweGaN AB, a manufacturer of custom-made GaN-on-SiC epitaxial wafers based on a unique epitaxial growth technology for RF and power components and devices has announced a new benchmark for GaN high-frequency devices based on SweGaN QuanFINE material. The demonstration promises commercial benefits for the entire GaN RF value chains including telecom, space, and military markets.

In a new joint study with the Chalmers University of Technology Department of Microtechnology and Nanoscience, SweGaN explored QuanFINE epitaxial wafer performance, based on GaN HEMT technology at Chalmers - Gothenburg, Sweden.

Collaborating with scientists from the university, the team performed a new benchmark comparing the conventional 1.8-μm thick iron-doped GaN buffer epi-structure to SweGaN’s ‘buffer-free’ QuanFINE GaN HEMT heterostructures for microwave applications. The study revealed that the new concept using a total GaN layer thickness of 250 nm does not compromise the material quality and device performance. Furthermore, the device results indicate that the ‘buffer-free’ QuanFINE material can outperform conventional materials at the device level in the long run.

For SweGaN customers and manufacturers, the ultimate benefits – resulting from the new ‘buffer-free’ concept, and including lower trapping, better carrier confinement and lower thermal resistance – could lead to higher device power efficiency and better reliability of GaN high-frequency devices.

Findings from the research collaboration are published in IEEE Electron Device Letters (Early Access) Microwave Performance of ‘Buffer-Free’ GaN-on-SiC High Electron Mobility Transistors by the joint research team of Ding-Yuan Chen, Anna Malmros, Mattias Thorsell, Hans Hjelmgren, Olof Kordina, Jr-Tai Chen and Niklas Rorsman.

“The new QuanFINE concept possesses many interesting features that are very attractive for both high frequency and power electronics,” says Niklas Rorsman, Research Professor at Chalmers University of Technology. “As an example, the possibility of a pure AlN back-barrier will be beneficial both for good electron confinement and thermal resistance. We at Chalmers are thrilled to be part of this development in GaN HEMT Technology.”

“Currently, GaN-on-SiC epitaxial wafers for Ka band applications are either immature or suffer from severe trade-offs,” says Jr-Tai Chen, CTO at SweGaN AB. “Our QuanFINE epiwafers are a highly feasible solution that can resolve issues our customers are dealing with regarding short-channel effects in the high-frequency devices.”

“We already have numerous product companies interested in our material as well as end users in the value chains,” continues Chen. “Four key target groups for QuanFINE epiwafers include the world’s leading foundries, IDMs (integrated device manufacturers), fabless companies, and end users, in Europe, Asia and USA. ”

Key demonstrations from the joint collaboration are:

• Physical simulations (TCAD) indicating that QuanFINE can be highly favourable for improved electron confinement.

• Pulsed-IV measurements that demonstrate a unique advantage of using the QuanFINE concept, showing a lower buffer-induced dispersion compared to the conventional thick, iron-doped buffer.

• Large signal measurements showing that the QuanFINE concept can provide highly competitive output power levels and efficiency, vastly beneficial to product companies and end users.

According to SweGaN, the beauty of the QuanFINE concept is a thin undoped GaN channel layer in between an AlGaN barrier layer and a AlN nucleation layer which acts as a sandwich-like double heterostructure – offering sufficient 2DEG confinement with much lower trapping effects as compared to conventional iron- and carbon-doped epi-structures. Moreover, the further reduction of GaN channel thickness will path a new road for small gate length devices as compared with conventional AlGaN back-barrier epi-structure, which suffers from weak thermal dissipation performance.

Further studies of the carbon impurity and the thickness of the UID GaN layer, are anticipated to continue to further improve the ‘buffer-free’ QuanFINE concept.

GaN Systems has announced the debut and availability of a new amplifier evaluation kit for high sound quality Class-D audio systems.

The evaluation kit includes a 2 channel, 200 W per channel (8 Ω) Class-D audio amplifier and companion 400 W, continuous power audio-grade SMPS. This solution highlights an easy plug and play design with features such as multi-audio signal inputs, bridge-tied load output, and open-loop/closed-loop toggling.

With GaN, the design is very efficient and operates without heatsinks. These features allow audio design engineers to create premium audio products at shorter time to market and at an affordable price.

The convergence of audio trends including demand for more power, size and weight reduction, and growing consumer demand for better audio quality requires innovative approaches to enhance sound quality, increase efficiency, and reduce size which is served by GaN power semiconductors. Applications include smart speakers to automotive and high-end home audio systems.

“Class-D Audio amplifiers are reaching a new level of performance with GaN. Industry experts and audiophiles alike have tested and listened to the output of our design and are truly impressed,” says Paul Wiener, GaN Systems’ VP of strategic marketing.

“The audio quality combined with the thermal and EMI/EMC performance provide a great solution for our customers.” Additionally, GaN Systems has published a new white paper, See, Feel, and Hear the Difference with GaN Class-D Amplifier and Companion SMPS, reviewing the GaN Systems audio evaluation kit using the standard set of industry performance and validation tests.

ZF Friedrichshafen AG, an automotive supplier, and VisIC Technologies, a maker of GaN devices for automotive high-voltage applications, has announced they will work together to create the next generation of high-performance and high-efficiency electric drivelines for vehicles.

The partnership will see the two companies deepen their development efforts, based on VisIC D3GaN semiconductors technology. The focus of the joint efforts will be on 400 V driveline applications, covering the largest segment of the electric vehicle market.

“Our partnership with ZF for the development of GaN-based power inverters in electric vehicles illustrates the break-through of GaN technology in the automotive industry,” said Tamara Baksht, CEO of VisIC.

“VisIC’s D3GaN technology was developed for the high reliability standards of the automotive industry and offers the lowest losses per Rds(on). It also simplifies the system solution and enables high-efficiency and affordable power train solutions. It is definitely the next step for the automotive electrical driveline.”

ZF’s fast adoption of semiconductor technologies such as SiC and GaN makes it a leader in the development of the most cost-effective and highly efficient electric drivelines. Through their extended R&D partnership, ZF and VisIC deepens their existing joint efforts in the application of GaN semiconductors for inverters.

Amid trying times, precursor supplier Ereztech has opened a US manufacturing facility to deliver more materials to more compound semiconductor manufacturers. Rebecca Pool investigates.

WHILE THE CORONAVIRUS PANDEMIC might be a surprising time to launch a manufacturing facility, Ereztech has done just this. In May this year, the manufacturer of organometallic precursors – critical to semiconductor thin-film deposition – opened its new R&D lab and manufacturing facility in Wisconsin, US.

The new operation adds US manufacturing capability to Ereztech’s Russia-based distribution network of precursor manufacturers and manufacturing operations. And it also allows the company to synthesize more exotic and reactive precursors based on pyrophorics and noble metals.

“Coronavirus and the subsequent economic challenges certainly add a layer of uncertainty, but we see this only as a short- to mid-term problem,” says Ereztech chief executive Roman Rytov. “This expansion brings our advanced and cost-efficient precursor development closer to our US customers, allowing for a broader product selection and accelerated development.”

“We started the process for setting up the facility back in 2019 and nobody predicted that this [pandemic] would happen but we are very positive about the future,” he adds.

Indeed, Rytov and his Ereztech colleagues are probably well-placed to deal with these uncertain times. Without a doubt, working with organometallic precursors is hardly a predictable business, with these reactive complexes often delivering surprising chemistry.

As Rytov puts it: “We’ve witnessed curious stories such as synthesising a molecule which the customer anticipated being solid and the end result was a liquid... This type of chemistry often surprises, but for us, this is normal.”

Indeed, for every ten new molecules that the company initially synthesises – to assess for stability and yield – only one will be suitable for further processing and scaling. So with this in mind, Ereztech has developed its so-called 25 grams programme, which promises at-cost synthesis of as little as 25 g of a target molecule, while protecting intellectual property for its customers.

According to Rytov, the programme allows molecule characteristics to be analysed swiftly and efficiently and can help to provide reliable and predictable pricing for larger molecule quantities.

“We believe this programme is unique amongst precursor materials manufacturers,” he says. “Due to the high risk of failure at this stage of precursor development, we decided to find out the absolute minimum viable amount of a molecule you need to synthesise, to understand how it works, and at 25 grams, this doesn’t come with a large price tag.”

And if the 25 g test batch is stable and meets purity standards, then Ereztech can refine the compound and eventually scale production to thousands of kilograms. “Customers can get 25 g of a new molecule for as little as US$1500,” says Rytov. “We’ve had tens and tens of molecules that have gone through this process... and molecules that have come out of this programme and gone into volume production with customers now make up some

50 percent of our overall business.”

For the semiconductor industry, and especially compound semiconductor players, this trial-batch method makes sense. As manufacturers become ever-more reliant on MOCVD and ALD vapour phase processing, having access to a reliable source of precursors is critical. And the slow but steady rise of ALD has also meant manufacturers can experiment with more options for volatile precursors.

During ALD, the gas precursors are typically pulsed into the reaction chamber one at a time to slowly deposit the thin film. Crucially, the release of precursors is separated by inert gas purging to avoid unwanted gas phase reactions.

As Ereztech’s chief technology officer David Roberts points out: “Separating these reaction components was a real game-changer and people have been using precursors that simply wouldn’t have even been considered back in the 1990s due to issues over contamination of the deposited material.”

“We’ve seen this explosion in precursor options that didn’t work well with CVD – many were rejected years ago, but are now coming back for ALD,” he adds.

Proliferating device types and shrinking geometries also see industry players experimenting with different thin films and epitaxial layers to achieve the finer features during deposition processes. Roberts points to the need for Group III-V channel replacements, Ta and Mn nitride sources for dimensionless copper barriers as well as high-k dielectrics for MOSFETs.

“Many manufacturers don’t want to necessarily use the usual metal-alkyl and metal-hydride ligand precursors, but want to try something a little different.” he says. “For example, we’ve seen increasing interest in gallium sources that are not alkyls... and I think people are really beginning to investigate this, particularly for nitrides.”

“We do also see a lot of work in the simple oxides; it’s amazing the utility of that kind of thin film, and sometimes it’s difficult to tell what manufacturers are using that for,” he adds.

Critically for Ereztech, the company will now be able to synthesize these more weird and wonderful, and reactive, precursors in its US facility. According to Roberts, importing such materials from Russia to the US had sometimes proven problematic; air travel wasn’t an option while shipment via sea was time-consuming.

Instead, the company can now manufacture more and more of these up and coming precursors in the US. Case in point is diethyl zinc, increasingly used to produce highly conductive and transparent ZnO layers for transparent electrodes in thin-film solar cells, piezoelectric sensors, transistors and more.

“This is a mainstay precursor in compound semiconductors and as we dig deeper into our new US capability, we can start to make more reactive materials such as this, that were difficult to bring into the country before,” says Roberts.

And as Rytov adds: “We are already making diethyl zinc, dimethyl zinc, pyrophorics and other products in the US... we’re also expanding our product line with a few noble metal precursors, while duplicating some of our Russia-made qualified products.”

Still, few would disagree that the opening of Ereztech’s new US lab in Wisconsin can’t be the easiest of endeavours right now. Covid-19 complications have shuttered many businesses, with the need for workplace sanitation, absences and limits to face-to-face interactions complicating operations worldwide.

However, Rytov isn’t fazed. “We are still working with our industrial partners – activities are slower, but we haven’t got any cancelled projects,” he says.

“Before this, industry forecasts had been so optimistic and positive, and we’d been dreaming about opening a US facility for years,” he adds. “So we will bite the bullet and pull through... we see lots of opportunities in the compound semiconductor space – these are interesting times.”

Ereztech is serving up precursor R&D, synthesis and volume manufacturing from its new US facilities.

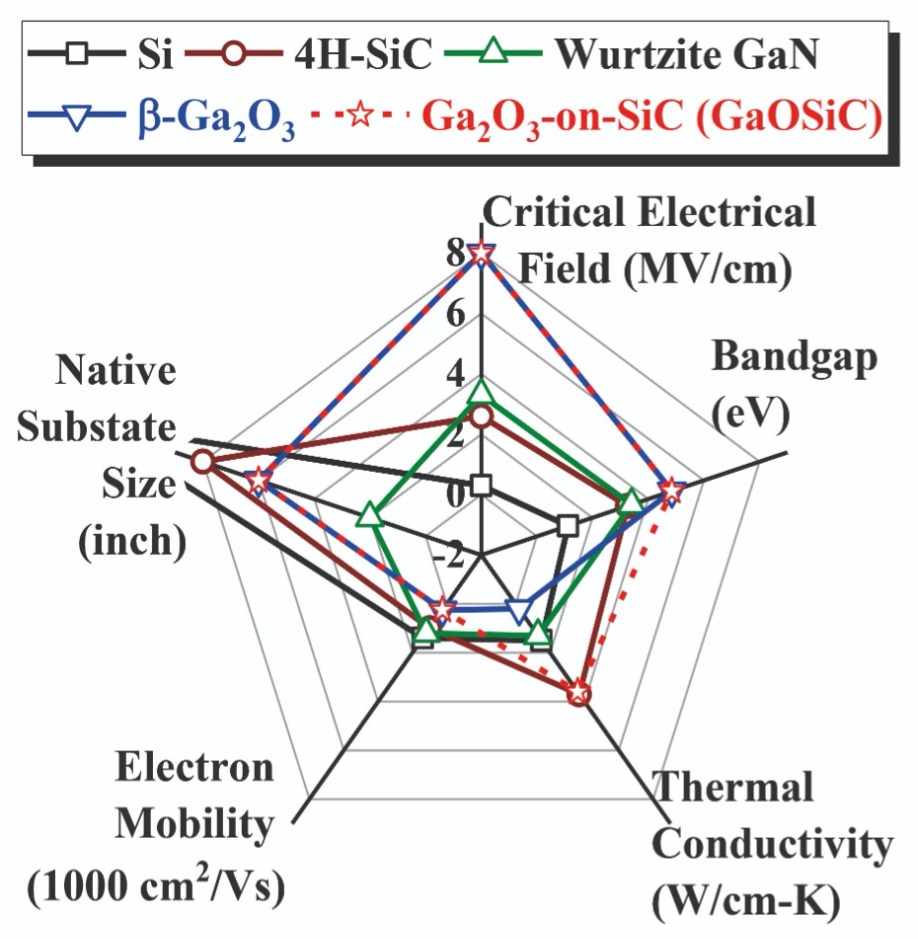

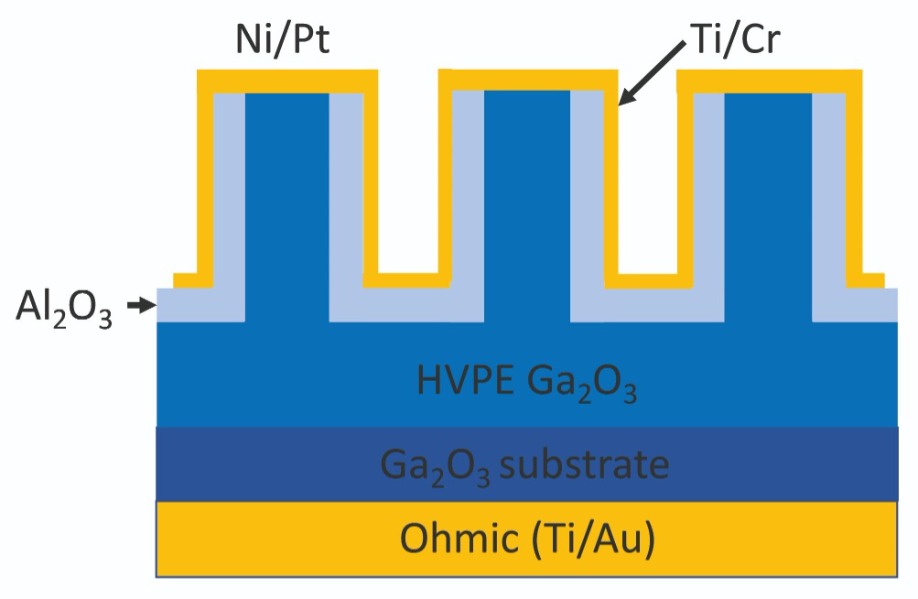

Thanks to the promise of substrate manufacturing costs that are comparable to sapphire and an ultra-wide bandgap that aids performance, gallium oxide power devices have the potential to displace those made from SiC and GaN by delivering a better bang-per-buck, argues National Energy Renewable Laboratory’s Senior Engineer and Analyst Samantha Reese and Scientist, Andriy Zakutayev.

INTERVIEW BY RICHARD STEVENSON

Q: When we look at wide bandgap materials for power electronics, there are the middleweights – silicon carbide and gallium nitride, which are today’s success stories – and the ultra-wide bandgap heavyweights gallium oxide, diamond and aluminium nitride. Do you think aluminium nitride and diamond can have any success?

SR: I definitely don’t expect diamond to have much of an impact, due to its high cost. However, maybe these devices could be used on satellites, where cost is far less of an issue.

My impression from attending the recent SPIE Photonics West conferences is that AlN has some technical challenges, so I’m not sure it will be a success in power electronics, but it may be useful for optoelectronics.

Q: Do you see gallium oxide as a competitor to gallium nitride? Or to silicon carbide? Or both?

SR: I think gallium oxide can take on both, as we could get devices with a low cost. Gallium oxide could easily take on silicon carbide, due to this. Gallium nitride, which is behind silicon carbide in terms of commercialisation, operates at lower voltages, and is lower in cost. But if gallium oxide gets to market quickly, it could thwart gallium nitride before it is established.

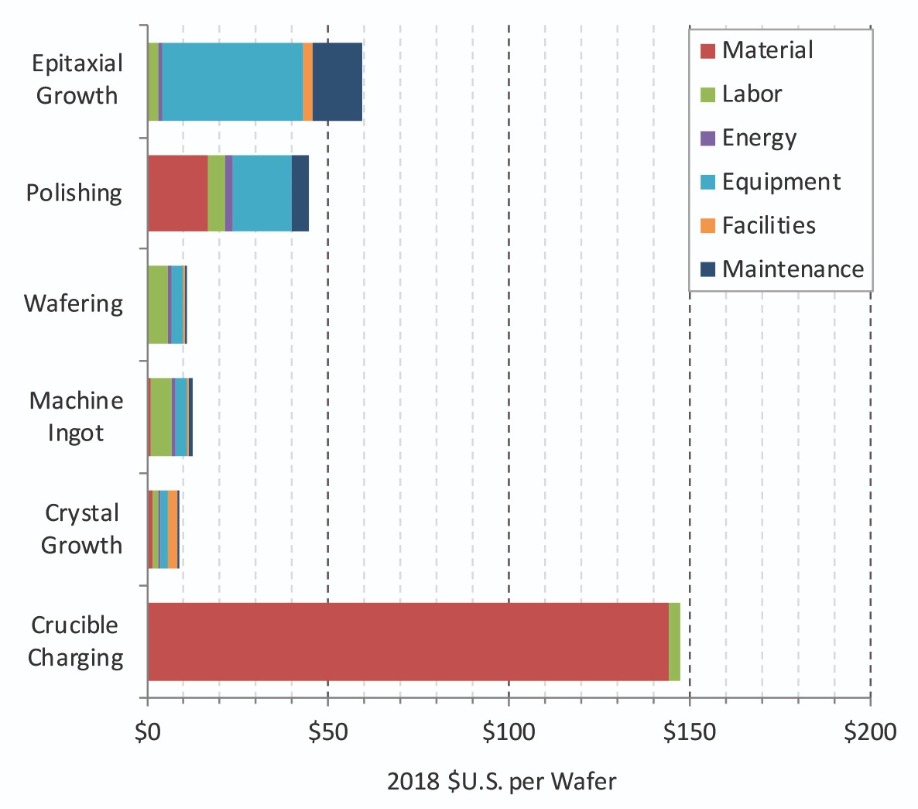

Figure 1. Ga2O3 wafer manufacturing cost by step

SR: The cost of the device depends on the cost of the wafer. Silicon carbide is a hard material, requires expensive material for wafer production, such as diamond-based polishing slurries, thus it is expensive to make. Producing gallium oxide boules is very similar to producing those of sapphire, which is used to make LEDs. So gallium oxide promises low cost.

AZ: The bulk single crystal growth from melt also has other advantages compared to chemical processes that are not directly captured in substrate cost but may impact device cost – for example, a lower defect density of the wafer, and better yield for subsequent device fabrication.

Q: Do you view the wide bandgap as the greatest strength of gallium oxide?

AZ: The biggest merit in my opinion is the availability of large-size, high-quality, electrically-dopable bulk single crystal substrates with projected low cost. This is qualitatively different from silicon carbide and gallium nitride, or aluminium nitride and diamond; the width of the band gap is only a quantitative difference.

SR: Its other strength is its ability to work at high temperatures. This is useful for making sensors that go down deep wells. It could be used by the oil industry, which needs medium-voltage devices.

Q: One of the weaknesses of gallium oxide is its low thermal conductivity. Could that be a show stopper?

SR: That depends on who you talk to. Gallium oxide devices can be very small and thin, so you can use very effective thermal management, even though the thermal conductivity is so low.

At the recent IEEE Workshop on Wide Bandgap Power Devices and Applications, a paper given by a colleague of mine – Paul Paret from NREL in Golden, Colorado – showed thermal modelling of gallium oxide devices attached to a base plate. Because the base plate can be so large compared with the size of the device, there was no impact associated with the low thermal conductivity.

AZ: In real-world power electronics systems, the overall thermal resistance is often limited not by the thermal conductivity of the substrate, but by the thermal resistance of various interfaces between the semiconductor chip and other components. So low thermal conductivity of gallium oxide may be not as big a problem as often perceived. Also it depends on the use – power electronics versus RF devices versus a myriad of other potential applications – and some are more sensitive to this problem than others.

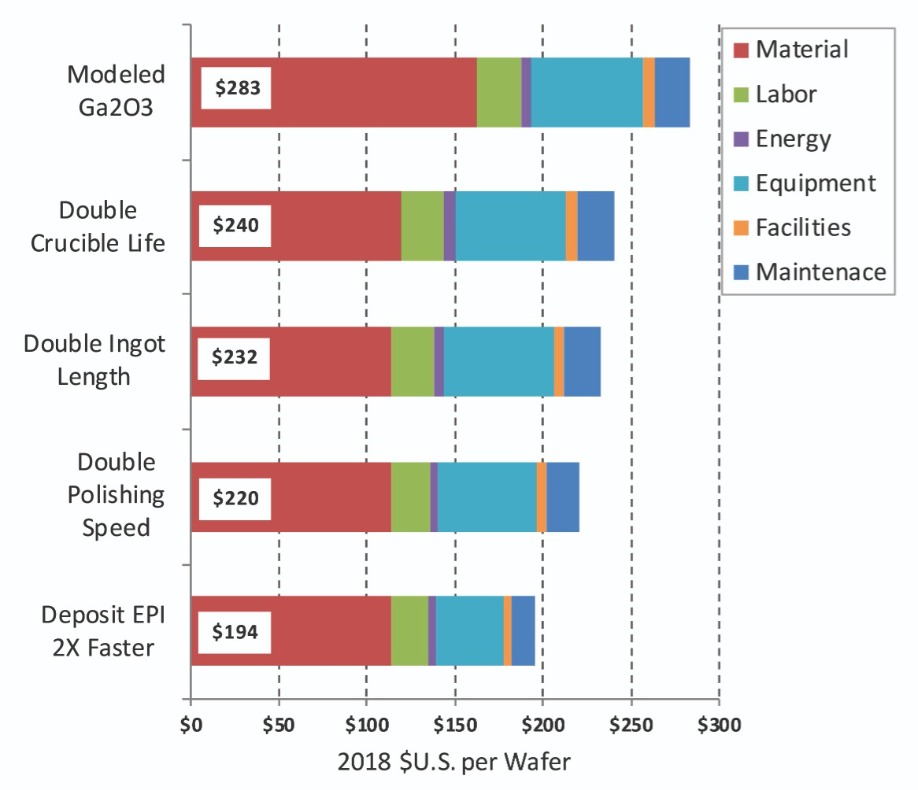

Figure 2. Ga2O3 Wafer Manufacturing Potential Cost Reduction Pathway

AZ: It is an issue for traditional device designs, but also an opportunity for creating thinking. For example, enhancement-mode – that is, normally-off – gallium oxide vertical transistors with breakdown voltage of more than a kilovolt have been demonstrated without p-type doping, using a FinFET-like structure, by a team led by researchers at Cornell.

Q: You have modelled the costs associated with producing gallium oxide devices. Tell me about the assumptions you make, and how they are justified.

SR: I modelled the cost of the gallium oxide wafer with an epilayer, and stopped at the wafer level. However, I think that the cost of making a device from a wafer could be similar for gallium oxide and silicon carbide.

The cost of producing gallium oxide is dominated by the iridium crucible. We have been very conservative in calculating this cost, assigning the number of times that it could be re-used to sources that were credible. We are confident that that it can be re-used ten times, however there were anecdotal references in literature that it could be re-used considerably more or refurbished without significant cost.

We have assumed that all the equipment for making the wafers has had to be bought new, and that there are no subsidies for the manufacturer. We also assume that the equipment is running all the time, apart from downtime for maintenance. Obviously, if you only make one or two gallium oxide wafers per month, it is going to be prohibitively expensive.

Another assumption that we made is that the gallium oxide wafers are 6-inch. Today they are commercially available in 2-inch or 4-inch, and 6-inch are in a development process, but we have used 6-inch in our modelling because we want an apples-to-apples comparison with the published silicon carbide cost.

Q: What were your key findings, in terms of wafer costs?

SR: Our figures are based on current material quotes for gallium oxide powder. If production took off, costs could come down, as there is not much of a market for gallium oxide powder today. With the stated assumptions, we find that the cost of gallium oxide is three times lower than silicon carbide, and with improvements could be five times less expensive. Additionally, gallium oxide wafer manufacturing could benefit from the expertise already gained in manufacturing of sapphire wafers.

Q: Why are the iridium crucibles so expensive?

SR: Iridium is a rare and expensive material. It’s not due to high processing costs for producing the crucible.

Q: Your work shows that the cost of a 6-inch gallium oxide wafer could be just under $300 – that’s a third of that for silicon carbide. That’s very encouraging. And you think it could be even lower than that. What are the most promising routes for getting the costs right down, and how big an impact could they have?

SR: The cost of the indium crucible could come down by 15 percent. If the size of the ingot were to double, this would provide an additional 3 percent saving. If the processing rate were to increase by 60 percent, then this could trim another 4 percent. A doubling of the growth rate could cut another 9 percent. If you put that all together, the cost of the wafer could come down from $300 to $200, a 33 percent reduction.

After that, replacing iridium with another metal would be the most promising transformative route.

Q: Novel Crystal Technology, a joint venture by Tamura Corporation and the National Institute of Information and Communications Technology, is producing gallium oxide material by two different methods. How do you think your findings relate to Novel Crystal’s production costs? Could there be differences due to economies of scale, and the maturity of the production process?

SR: I can’t comment on Novel Crystal Technology or other specific companies. However, at a conference one gallium oxide substrate maker indicated that their internal costs of production are very similar to those of our model, when they make the same assumptions. This is the best validation of our work we can get.

When companies produce just a few wafer per month, the manufacturing costs will be higher. But when you scale to volume, the costs will come down.

Q: Does a lower wafer cost directly translate into a lower bill-of-materials for a device?

SR: It is not a one-to-one scenario. There are other ‘fixed costs’. For about a three-fold reduction in the cost of the epi-wafer, the device would be about half as expensive, since the wafer is usually 60-to-70 percent of the cost of the device.

With wide bandgap devices, whether they are silicon carbide or gallium oxide, they can produce cost reductions at the system level, thanks to a reduction in the cost of the magnetics.

There is also an increase in the efficiency. Take a 50 kilowatt inverter, for example. Turning to gallium oxide devices might provide a 5 or 6 percent increase in efficiency, leading to a 2 percent increase in the electrical output from a solar farm, so an increase in revenue.

Q: Which company’s do you think will bring the first devices to market? Flosfia of Japan?

AZ: Our SPIE and Joule papers are about β-gallium oxide, which has a monoclinic structure. Flosfia is working on a-gallium oxide, which has a hexagonal ‘corundum’ structure that is similar to sapphire. That is a completely different technology. It’s not clear yet which company would emerge as a leader in β-gallium oxide devices.

Q: With silicon carbide, it took more than a decade to follow up the launch of the first Schottky barrier diode with the first MOSFET. With gallium oxide, do you expect diodes to launch first, followed by MOSFETs? And could the gap between them be a decade or more?

SR: I think it will probably be diodes first, but the wait for MOSFETs will be shorter than it has been for silicon carbide. That’s because silicon carbide has helped to pave the way for the commercialisation of gallium oxide. For example, contact layer sintering processes have been established, and there are high-temperature modules that gallium oxide devices can be designed into. The US Air Force Laboratory is very excited about gallium oxide. And if you look at the number of papers published in total, you can see that there is major interest in gallium oxide worldwide.

AZ: I agree that it is likely that gallium oxide Schottky barrier diodes will be commercialised first, because their fabrication technology is relatively straightforward. However, lateral radio-frequency transistors similar to gallium nitride may be commercialized sooner than vertical power transistors similar to silicon carbide.

SR: I can’t comment on Novel Crystal Technology or other specific companies. However, at a conference one gallium oxide substrate maker indicated that their internal costs of production are very similar to those of our model, when they make the same assumptions. This is the best validation of our work we can get.

When companies produce just a few wafer per month, the manufacturing costs will be higher. But when you scale to volume, the costs will come down.

Q: Does a lower wafer cost directly translate into a lower bill-of-materials for a device?

SR: It is not a one-to-one scenario. There are other ‘fixed costs’. For about a three-fold reduction in the cost of the epi-wafer, the device would be about half as expensive, since the wafer is usually 60-to-70 percent of the cost of the device.

With wide bandgap devices, whether they are silicon carbide or gallium oxide, they can produce cost reductions at the system level, thanks to a reduction in the cost of the magnetics.

There is also an increase in the efficiency. Take a 50 kilowatt inverter, for example. Turning to gallium oxide devices might provide a 5 or 6 percent increase in efficiency, leading to a 2 percent increase in the electrical output from a solar farm, so an increase in revenue.

Q: Which company’s do you think will bring the first devices to market? Flosfia of Japan?

AZ: Our SPIE and Joule papers are about b-gallium oxide, which has a monoclinic structure. Flosfia is working on a-gallium oxide, which has a hexagonal ‘corundum’ structure that is similar to sapphire. That is a completely different technology. It’s not clear yet which company would emerge as a leader in b-gallium oxide devices.

Q: With silicon carbide, it took more than a decade to follow up the launch of the first Schottky barrier diode with the first MOSFET. With gallium oxide, do you expect diodes to launch first, followed by MOSFETs? And could the gap between them be a decade or more?

SR: I think it will probably be diodes first, but the wait for MOSFETs will be shorter than it has been for silicon carbide. That’s because silicon carbide has helped to pave the way for the commercialisation of gallium oxide. For example, contact layer sintering processes have been established, and there are high-temperature modules that gallium oxide devices can be designed into. The US Air Force Laboratory is very excited about gallium oxide. And if you look at the number of papers published in total, you can see that there is major interest in gallium oxide worldwide.

AZ: I agree that it is likely that gallium oxide Schottky barrier diodes will be commercialised first, because their fabrication technology is relatively straightforward. However, lateral radio-frequency transistors similar to gallium nitride may be commercialized sooner than vertical power transistors similar to silicon carbide.

P. Paret et al. “Thermal and Thermomechanical Modeling to Design a Gallium Oxide Power Electronics Package.” 2018 IEEE 6th Workshop on Wide Bandgap Power Devices and Applications (WiPDA). IEEE, 2019

Z. Hu et al. “Enhancement-mode Ga2O3 vertical transistors with breakdown voltage> 1 kV.” IEEE Electron Dev. Lett. 39 869 (2018)

S. Reese et al. “Regional Manufacturing Cost Structures and Supply Chain Considerations for Medium Voltage Silicon Carbide Power Applications.” ASME 2018 13th International Manufacturing Science and Engineering Conference. https://asmedigitalcollection.asme.org/MSEC/proceedings-abstract/MSEC2018/51364/V002T07A004/277049

Singh et al. “Performance and Techno-Economic Evaluation of a Three-Phase, 50-kW SiC-Based PV Inverter” [DOI: 10.1109/PVSC40753.2019.8980752]

S. Reese et al. “How Much Will Gallium Oxide Power Electronics Cost?” Joule 3 903 (2019) https://doi.org/10.1016/j.joule.2019.01.011

S. Reese et al. “Gallium oxide techno-economic analysis for the wide bandgap semiconductor market.” In Oxide-based Materials and Devices XI 11281 p. 112810H. International Society for Optics and Photonics, 2020. https://doi.org/10.1117/12.2565975

If you picked the right companies in the compound semiconductor industry, your shares will have

seen substantial gains over the last 12 months.

BY RICHARD STEVENSON

Although there is more than half the year still to go, there is no doubt what 2020 will be remembered for. Covid-19 continues to dominate the agenda, and is likely to do so for the foreseeable future.

One way to assess the devastation of this global pandemic is to consider its impact on the world’s health. The death toll is now north of 300,000, and is sure to finish far higher. But even that alarming number fails to capture the full extent of its destruction. A meaningful assessment must also include the ramifications of the reductions in treatment of other conditions, such as cancer; the consequences for mental health; and a shortening of life expectancy, resulting from a loss of earnings. Another aspect to consider is the economic fallout. Many millions have already lost their jobs, and it is not clear when some sectors will start to recruit again.

There are many ways to track the economy. There are employment figures, gross domestic products and yet another barometer that may be harder to interpret – the stock market. When Covid-19 transitioned from epidemic to pandemic in the early months of this year, shares fell at breakneck speed, but since then there has been significant recovery, probably reflecting that the situation could have been far worse. By the end of April the Dow Jones had fallen by less than 10 percent over the last twelve months, while the tech-heavy NASDAQ had climbed nearly 8 percent, an astonishing gain given the devastation caused by Covid-19.

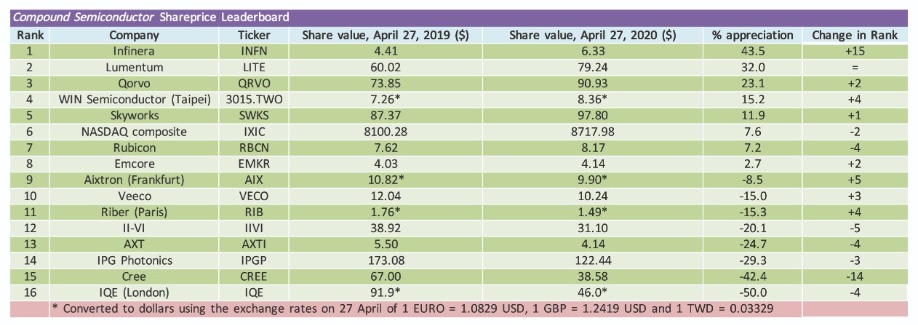

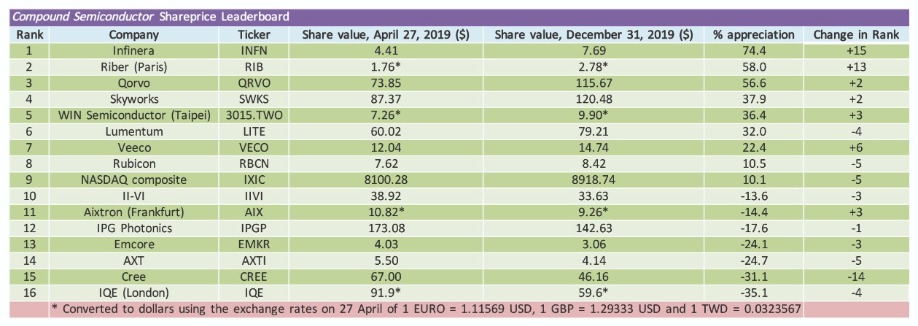

What about shares in the compound semiconductor industry? Well, throughout the latter part of last year many made significant gains – and in general, those that set the pace back then are still leading the pack, having undergone significant increases in valuation since April 2019. This is illustrated in the two Share Price Leaderboards produced for this year: one considers a year of trading up until 27 April, and the other evaluates the period between 27 April 2019 and New Year’s Eve, a timeframe where Covid-19 had no impact in any stock market.

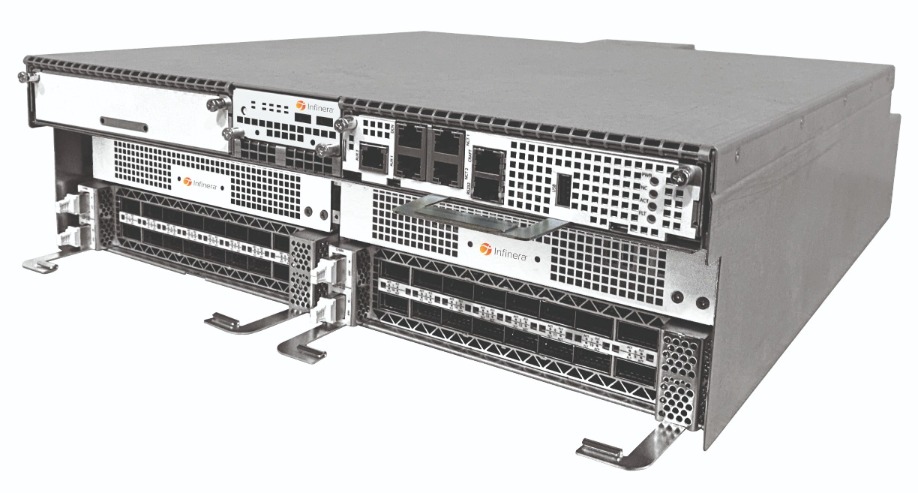

In early April 2020 Infinera released its GX Series of compact modular solutions. This is claimed to add improved scalability and carrier-grade features to modern data centre-style networking approaches.

Compare them and you’ll see that Riber, the French manufacturer of MBE tools, is bucking the trend of most of the companies with significantly different standings in our two tables. Its share price shot up in late 2019, but has fallen steadily throughout this year to just below where it stood in Spring 2019, with declines beginning well before the pandemic spread to Europe.

It is likely that the soaring share price in November and December 2019 came from a flurry of significant equipment orders that have not continued into this year. In the last two months of 2019 Riber revealed several new orders, totalling six machines for research and one more for production. This promised to provided substantial growth in total sales, but it didn’t, due to a collapse in evaporator sales to makers of OLED-based products.

This substantial shift in the breakdown of Riber’s revenue is revealed in its results for fiscal 2019. For that year income from MBE systems contributed Ä23.0 million, up 140 percent year-over-year, while evaporator sales plummeted from Ä11.6 million to just Ä1.0 million. The third source of income, contracts for services and accessories, had a modest annual decline, falling from Ä10.1 million to just Ä9.4 million. The upshot of all these changes: revenue stood at Ä33.4 million, up Ä1.9 million over the previous year.

Riber has just reported its first quarter results for 2020. The order book is down 18 percent compared with the same time in 2019. There are no orders for evaporators, said to reflect a lack of investment within the OLED screen industry, while orders for systems are totalling Ä18.9 million and those for services and accessories ae worth Ä7.6 million. The reduction in the bookings has been caused by the pandemic, which has led to difficulties in finalising contracts with Asian customers.

Another consequence of the rise of Covid-19 infections during March and April has been a lockdown in France. Some of Riber’s employees are now working from home, while others are going to the site, enabling the company to still produce and deliver. Strategic projects are also running. However, Riber is facing a slowdown in commercial activity, with orders deferred, especially from China. Riber hopes this will not continue, given that China is its biggest market, where the 5G market is claimed to be “very buoyant”.

Infinera’s share price has shot up over the last twelve months, but is still below its value from April 2018.

From bottom to top

It’s been an encouraging 12 months for Infinera, the vertically integrated manufacturer of telecommunication equipment. This US-based firm has moved from last place on our Leaderboard to pole position, thanks to a share price that climbed from below $5 in late April 2019 to almost $8 by the end of the year and did not suffer from a substantial decline during the first few months of 2020. Note, however, that Infinera’s current valuation is still well short of the April 2018 price of almost $12.

The reasons behind both the rise in Infinera’s share price and the fall in its valuation over the last few years are illustrated in the company’s financial results. Take a look at the figures for the fourth fiscal quarter 2019, reported on 25 February 2020, and you’ll see that the profitability realised several years ago is either tiny or gone, depending on how you do the accounting, but gross margins and sales are heading in the right direction. Revenue for the fourth quarter exceeded guidance, hitting $384.6 million, which is up $59.3 million sequentially and a gain of $52.5 million compared with the equivalent quarter of 2018. Meanwhile, gross margin for the fourth quarter is 29 percent, up 2.3 percent sequentially and an increase of 3.6 percent year-on-year – but well short of the values north of 40 percent, reported around 2015.

During a call discussing fourth fiscal quarter earnings on 25 February, those leading the company painted a promising picture for the future. Reasons for an upbeat outlook included growing revenues, a diversified customer base and an expanded product portfolio.

According to company CEO Tom Fallen, fiscal 2020 will witness an important milestone in Infinera’s high-performance optics – it will mark a transition to fifth-generation, 800-gig capable technology that features digital signal processing (DSP).

Share price leaderboard 2020

In his opinion, vertical integration, which has historically provided a way to reduce cost, is now critical to success in the market place. And this is good news for Infinera, as it limits the number of competitors.

“We do not see commercial optical components being broadly available for 800-gig until late this year or 2021,” claimed Fallon. “By designing and manufacturing our own DSP and optical components, we expect to deliver 95 gigabaud fifth-generation optical systems to the market before commercial components are widely available.”

Another development that Fallon expects to aid Infinera is the prioritisation of 400-gig products by commercial DSP manufacturers. “This creates a scarcity in sources of supply for 800-gig technology and opens a tremendous opportunity for those that are vertically integrated and early to market.”

Infinera remains on track to deliver 800-gig product during the second half of this year, with revenues expected to ramp in 2021.

During the February earnings call, Infinera provided a financial outlook for the future. For the first fiscal quarter 2020 revenue is expected to be $315 million to $335 million. This figure included a $15 million impact from the coronavirus, due to ancillary merchant optics sourced from the Wuhan area.

Nancy Erba, Infinera’s CFO, also spoke in the call, providing an outlook beyond the third fiscal quarter. Back in February she said that the market that Infinera serves is expected to grow at around 6 percent – but it could be less than this, depending on the extent of the Covid-19 outbreak. She predicted that Infinera’s growth would outpace this, due to the positioning of its portfolio, with gross margin climbing by 2 to 4 percent in both fiscal 2020 and fiscal 2021. “Into 2022, we expect to continue growing faster than the market and achieve our target business model of gross margins in the mid-40 percent and double-digit operating profit,” said Erba.

Share price leaderboard for the time period up until the end of December 2019

The most recent quarter has not been a good one for the company. While revenue met guidance, with sales totalling $331 million, gross margins dived to 23.3 percent, 5 percent below expectations. This did not go down well with investors, as the share price plummeting by more than 10 percent.

One of the reasons behind the fall in gross margin is the involvement in a subsea consortium build, coming a quarter early. The other issue is related to substantial shipments of the company’s 200-gig Groove solution, which is based on merchant optical engines.

Fallon revealed during the call that during the quarter Infinera experienced supply chain disruptions, due to many countries imposing public health restrictions that impacted the production and delivery capabilities of the company’s vendors around the world. “This disruption had a negative impact on our ability to fulfil certain customer requests during the quarter.”

Looking ahead, Fallon is concerned that the macroeconomic uncertainty felt by Infinera’s customers could more than offset the continued expansion of bandwidth demand. “To address this uncertainty, we are taking proactive measures to reduce operating expenses and improve gross margin.” Measures that taken include a temporary reduction of salaries for senior management and the Board of Directors, and staffing reductions, largely in the area of contract positions – they are said to have little impact on the company’s regular global worker force.

These steps are expected to deliver savings of between $5 million and $7 million, and should have an impact on results for the second fiscal quarter. Guidance for that is revenue of between $310 million and $330 million, and a gross margin of 27 percent to 31 percent.

Qorvo claims that it is supporting Samsung’s Galaxy S20 platform with a broad set of high-performance, highly integrated components.

Up one place from last year, Lumentum is now taking second spot on our Leaderboard, thanks to a share price that has risen from around $60 to $80 during the last twelve months.

The increase in the valuation of this manufacturer of many forms of laser reflects an improved balance sheet. For example, for the second fiscal quarter of 2020, ending on 28 December 2019, sales netted a record $457.8 million, up $7.9 million sequentially and $84.1 million year-over-year. Gross margins also improved over that timeframe, increasing from 33.4 percent for the second fiscal quarter of 2019 to 37.3 percent and 41.3 percent for first and second fiscal quarters of 2020, respectively.

On 5 May the company reported the results for the third fiscal quarter 2020. For that three-month period, ending on 28 March 2020, the Covid-19 pandemic had a significant impact on sales and margins. Quarterly sales dropped to $402.8 million – that’s $10 million below prior guidance given on 4 February that anticipated an impact from the pandemic of $15 million to $20 million. However, this shortfall did not alarm investors, nor the lower guidance for the fourth quarter, with the share price nudging up a few percent following the release.

During the call on 5 May, company CEO and founder Alan Lowe explained that the pandemic is expected to diminish fourth fiscal quarter revenue by more than $90 million: “Little more than half of this $90 million is a result of our inability to supply communication products, due to both component sourcing and production limitations – and the balance is from reduced consumer and industrial market demand.”

While the short-term impact of Covid-19 is not good for business, the changes it brings in the longer term could be, reasoned Lowe. “We believe Covid-19 will accelerate the shift to increasingly digital and virtual approaches to work, entertainment, education, health care, social interaction and commerce around the world.”

In autumn 2019 Lumentum moved its headquarters to a three-building office campus, known as Ridder Park Technology Center.

Lowe provided a great deal of detail on the impact of the pandemic on the company’s various facilities.

At Lumentum’s factory in Shenzhen, China, many employees worked through the Chinese New Year holiday so that the company could quickly ramp production at the factory when the nation returned to work. But this plan has been hampered by difficulties in obtaining components from third-party suppliers inside and outside China. The situation is improving, but will have some impact on fourth-quarter results.

Lowe explained that at the Thailand facility, employee protective measures were rapidly implemented in the third quarter. “These measures had not limited output so far, but production in Thailand has been impacted by the same challenges that our Shenzhen factory is experiencing with sourcing components.”

In Malaysia, Lumentum has a contract manufacturing partner for most of its telecom transmission products. Due to local government action to address the pandemic, production halted for several weeks from mid-March, and has been slowly ramping since then.

Operation continues at Lumentum’s wafer fabs, located in the US, Japan and the UK. They are used to make datacom chips, telecom transport and commercial laser products, and telecom transmission products, respectively. At these sites, social distancing measures are a drag on efficiency.

Like many companies, staff that can work from home are doing so. “The increase in network traffic we have created with our virtual meetings, where we have added more than one million median minutes per week since early February, is an indicator of bandwidth growth,” said Lowe, citing this as further evidence that the future is very bright for Lumentum.

Before the Covid-19 outbreak, demand for Lumentum’s telecoms and datacom product lines was “very strong and accelerating”, according to Lowe, with volumes constrained by supply. Demand maintained its strength throughout the third quarter, but revenue fell 6 percent, with the pandemic exacerbating existing supply challenges. Despite these issues, Lumentum continues to grow its sales for voltage-controlled oscillators and InP high-bandwidth products for 600 gig and 800 gig systems.

Lowe revealed that quarter-on-quarter sales for the telecom transport product line were “approximately flat”, while datacom chip revenue climbed 20 percent sequentially.

Due to seasonal factors, Lumentum’s revenue from its industrial and consumer product lines fell by 24 percent compared with the previous quarter. However, sales were up 40 percent year-over-year.

In the third quarter, the company ramped production of its lasers for world-facing cameras and LiDAR for consumer applications. But now, due to Covid-19, sales of its lasers for 3D sensing are expected to drop by more than 40 percent, due to weak consumer demand and the potential for smartphone supply challenges.

A decline in fibre laser sales during the third quarter led to a $43.5 million fall in revenue. “We expect over the next several quarters, that our fibre lasers business will soften further, as it is tied to growth in global manufacturing,” said Lowe.

Despite the uncertain future, Lumentum is recruiting. At its facility in the UK, it hopes to add around 200 staff so that it can ramp its transmission products.

The company is giving to its community during the outbreak. “We have used our commercial supply chains to procure and donate personal protective equipment to health care providers,” said Lowe. In addition, Lumentum has expanded its charitable donation programmes, and its staff have been using internal capabilities to produce and donate limited quantities of PPE.

Qorvo: 5G growth

Another company that has seen a gain in valuation after releasing its latest quarterly results is Qorvo. It has taken third spot on this year’s Leaderboard, just outperforming peers WIN Semiconductor and Skyworks.

Qorvo’s balance sheet shows that it is going from strength to strength. For fourth fiscal quarter 2019, ending on 28 March 2020, sales netted $787.8 million, up $106.9 million year-over-year, while gross margins climbed by 3.4 percentage points to 42.6 percent.

Uptake of 5G is helping to swell sales. “Products like our 5G ultra-high-band solutions are being adopted across customers and on all leading 5G chipsets,” said company President and CEO Robert Bruggeworth during fourth quarter earnings call on 7 May. Some of these products, including what is described as mid-high-band and ultra-high-band 5G solutions, are going into Samsung’s Galaxy S20 platform.

Further sales related to 5G are coming from shipments of GaN high-power amplifiers and small-signal components supporting sub-6 gigahertz 5G networks. “Demand for Qorvo’s products has been robust, driven by the ramp of massive MIMO antennas,” says Bruggeworth.

The capabilities of Qorvo have grown this year through the acquisitions of Custom MMIC and Decawave. The former strengthens the portfolio of GaAs and GaN RF products for defense and aerospace, while the latter provides ultra-wide-band technologies for proximity awareness, secure payments, and secure access for smartphones, automotive and IoT.

Qorvo’s factories and engineering labs are remaining open during the pandemic. In addition, product development schedules are running, design and engineering teams are still developing new technologies, and the company is continuing to have strong interaction with its customers.

However, revenue will be down in the next quarter, due to the consequences of the Covid-19 outbreak. This is not impacting all product lines: while sales of mobile products are expected to fall, those from the infrastructure and defence division are expected to rise, thanks to greater demand for 5G infrastructure and the latest generation of Wi-Fi technology.

Based on all these considerations, revenue for the first fiscal quarter of 2020 should be between $710 million and $750 million. This range is wider than normal, reflecting greater uncertainty in the markets and the broader economy due to the effects of Covid-19.

IQE’s decline in income

Footing this year’s table is international epiwafer supplier IQE, which has seen its share price halve during the last 12 months. This fall reflects a decline in annual revenue from £156.3 million in 2018 to £140 million in 2019, resulting from reduced sales to a wireless customer that has been affected by changes in global markets and a photonics customer that has suffered from technical issues that are not related to IQE’s wafers.

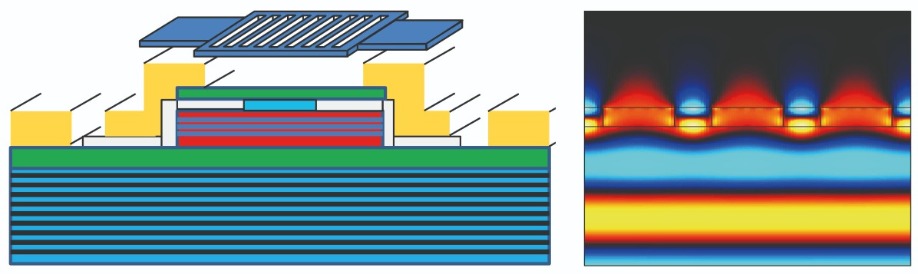

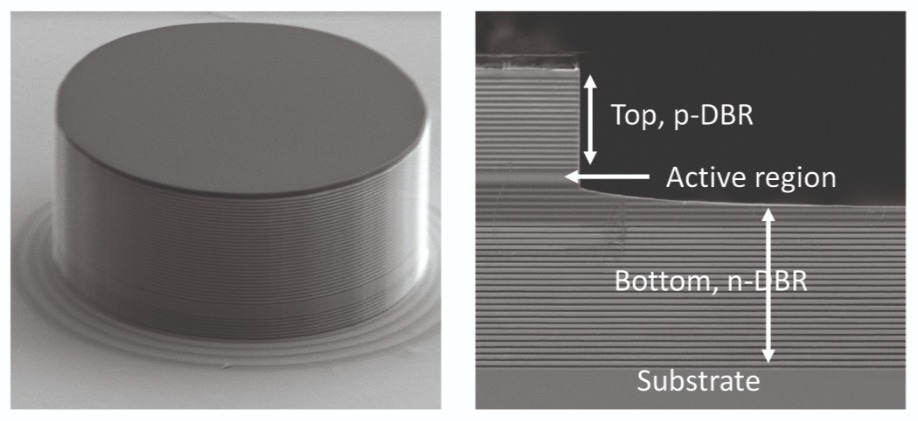

Another key insight provided by the full year results, released on 28 April, is that despite the loss of a photonic customer, IQE’s revenue from this division increased by 4.4 percent to contribute £66.8 million, with half of those sales associated with VCSEL products. Meanwhile, wireless revenue fell by 22.4 percent to £68.2 million, due to a significant decline in volume from a GaAs power-amplifier customer. Loss in revenue has impacted the bottom line.

According to adjusted operating figures, IQE made a loss of $4.7 million last year, compared with a profit of £16 million in 2018. Company finances have not been helped by a bill for £4.3 million for legal costs, associated with a confidential patent dispute.

The Covid-19 pandemic is not having a major impact on production capability, with all sites around the globe remaining operational. As is the norm in the industry, staff are working from home where able. Other changes to operations include an increase in cleaning regimes and planning for shift segregation.

The outbreak has created much uncertainty in the market, and has led IQE to withdraw from offering specific guidance. However, it did reveal that its first-quarter trading exceeded expectations, and described the outlook for the second quarter as “positive”.

In the last few years, IQE has invested in infrastructure that should lead to higher margins and increased capacity. It has built a large foundry in Newport, South Wales, that has started to manufacture 3D sensing products; it has increased it wireless capacity in Taiwan to address changes in global supply chain dynamics; and it has built GaN capacity in Massachusetts to capitalise on forthcoming 5G infrastructure deployments. With all this in place, investment in property, plant and equipment is expected to significantly reduce in 2020 to below £10 million.

Despite the uncertainty in the near-term, IQE continues to invest in the generation of new products. It will spend £10 million this year developing: 10G and 25G distributed feedback lasers and avalanche photodiodes for high-speed datacoms and 5G fronthaul and backhaul; 5G switches and filters, which are based on its patented crystalline rare-earth oxide technology; long-wavelength VCSELs for future smartphone and LIDAR deployments; and lasers and sensors for environmental and health monitoring.

Such investment should serve IQE well. While the near-term may be tough, it has much promise for the future. It share price will surely rise, and like many companies from different sectors in our industry that have found themselves footing the table, it has the potential to rapidly climb up our Leaderboard.

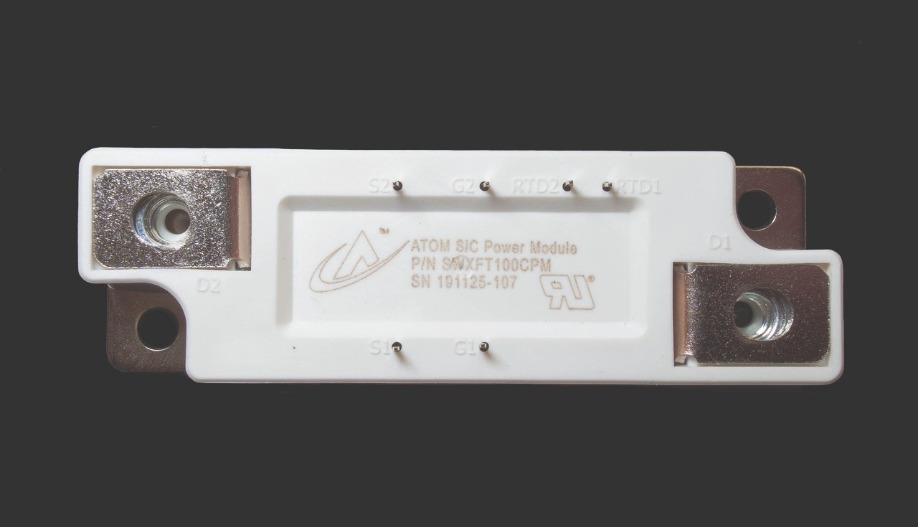

Custom-based modules made from SiC MOSFETs minimise the impact of short circuits and overloads

BY DENIS KOUROUSSIS FROM ATOM POWER

At some point in the career of nearly every electrical engineer they would have wondered whether it is possible to design a circuit breaker that is not mechanical in nature. Many will reason: Isn’t it better to use a semiconductor to break a fault or handle an overload?

However, when they delve more deeply into this issue, they’ll start to run into roadblocks. One is that the power devices that they are familiar with have a breakdown voltage of around 600 V, so many of them would have to be stacked in series, even when making a circuit breaker for a low-voltage industrial applications that runs off a 480 Vrms AC supply.

Another issue is that when the power flows through any semiconductor device, it creates substantial heat, due to resistances that are significantly higher than those of traditional metal contacts. As this heat must be dissipated, the entire architecture of today’s circuit breaker has to be ‘re-thinked’, before starting to design this product.